Different Answer

Blog

By Jennie James

•

21 Feb, 2022

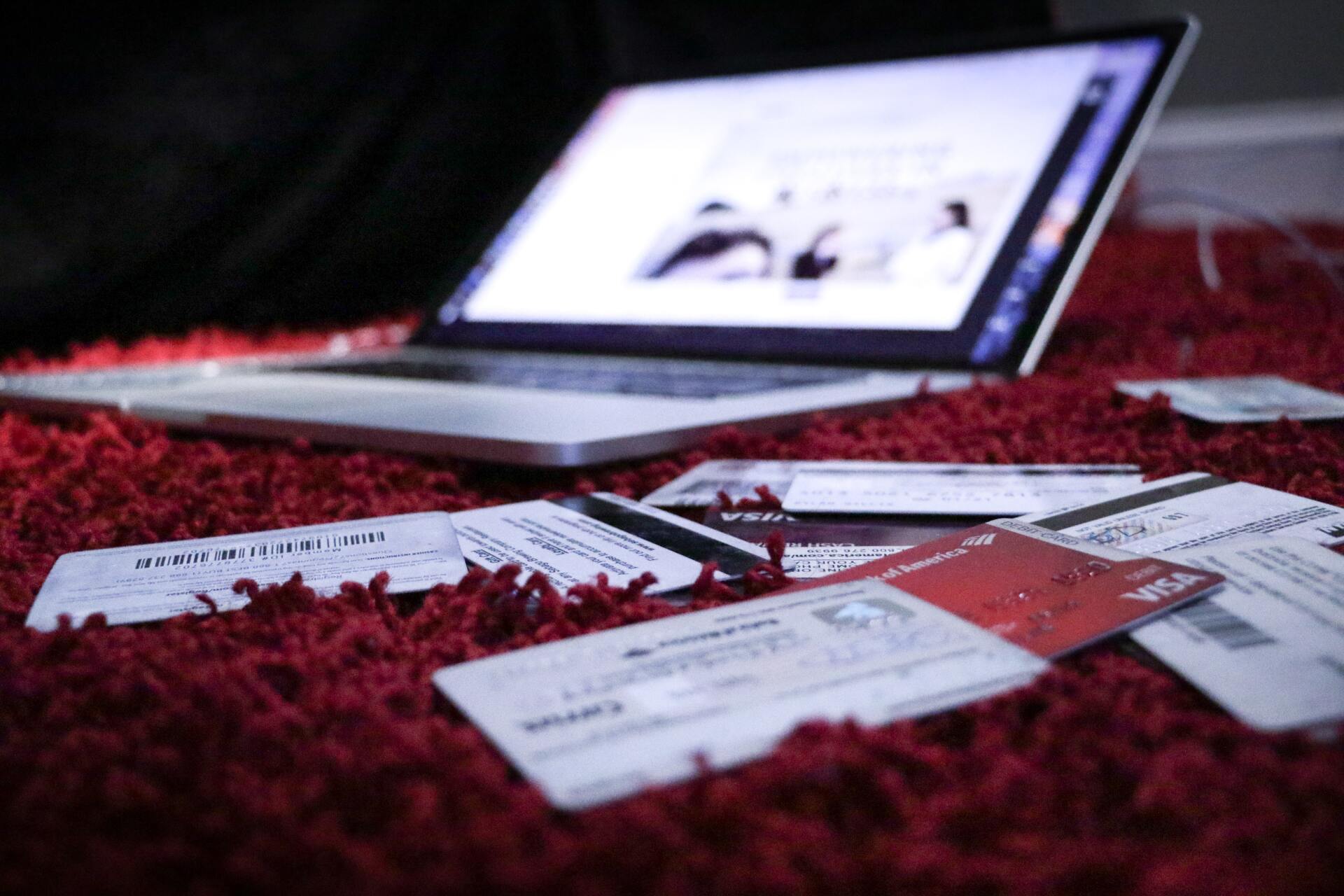

Debt is a crisis for everyone in the United States, but especially for people of color. For African American families, the debt crisis is largely due to the many types of discrimination the Black community faces that perpetuate wealth inequality. According to 2019 stats from How Money Works, the average Caucasian family has about $188,200 in wealth accumulation—while Latino families have only an average of $36,000 saved, and African American families have only accumulated $24,100 on average. Unable to create the nest eggs necessary to address large and emergent expenses that may arise and cause debt for families, African Americans are kept from any generational wealth accumulation or ability to better their circumstances for future generations. In other words, they are prevented from attaining the American Dream. “Less wealth translates into fewer opportunities for upward mobility and is compounded by lower income levels and fewer chances to build wealth or pass accumulated wealth down to future generations,” reports Center for American Progress. Already, the Black community is experiencing the consequences of such blatant and intentional wealth inequality, proving that the cycle is only set to continue unless some major systemic changes are put in place. “The moment they earn their bachelor’s degrees, black college graduates owe $7,400 more on average than their white peers ($23,400 versus $16,000, including non-borrowers in the averages). But over the next few years, the black-white debt gap more than triples to a whopping $25,000. Differences in interest accrual and graduate school borrowing lead to black graduates holding nearly $53,000 in student loan debt four years after graduation—almost twice as much as their white counterparts,” reports one study from Brookings . Clearly, a deeper exploration into some of the major reasons behind the disproportionate effects debt has on BIPOC communities is in order, especially as we wrap up February’s Black History Month, and more especially as BIPOC families explore their options for getting out of debt. Labor Market and Employment Discrimination There is a long and well-documented history of racial disparities in employment outcomes in the United States due to discrimination in the labor market. In essence, due to racism and prejudice, it’s harder for African Americans to get jobs, let alone the jobs that can afford them savings, assets, and the chance at upward mobility in society. In fact, “Black workers are twice as likely to be unemployed as white workers overall (6.4% vs. 3.1%). Even black workers with a college degree are more likely to be unemployed than similarly educated white workers (3.5% vs. 2.2%),” reports the Economic Policy Institute. What’s more, often those African Americans who are employed are under-utilized and unable to better their skills in the workplace, research shows . Therefore, not only are African Americans often unable to get work, they are very rarely able to acquire the skills and education that may help them climb the corporate ladder and build their savings. “African American workers still face more hurdles to get a job, never mind a good one, than their white counterparts. They continue to face systematically higher unemployment rates, fewer job opportunities, lower pay, poorer benefits, and greater job instability,” reports the Center for American Progress . “These persistent differences reflect systematic barriers to quality jobs, such as outright discrimination against African American workers, as well as occupational segregation—whereby African American workers often end up in lower-paid jobs than whites—and segmented labor markets in which Black workers are less likely than white workers to get hired into stable, well-paying jobs.” Job discrimination, thus, creates a lower level of opportunity and more debt for African Americans, as they are often unable to procure the jobs that pay well enough to allow them to weather emergency expenses or other unforeseen debts. Mortgage Market Discrimination Along with reduced access to well-paying jobs and job training, African Americans own homes at lower rates, which also impacts their ability to build wealth. This is sometimes due to their income, which is impacted by job discrimination, but it’s also because they are blatantly discriminated against in the mortgage market. As one CNBC article wrote, “A majority (59%), of Black homebuyers are concerned about qualifying for a mortgage, while less than half (46%) of White buyers are, according to a recent survey by Zillow, a home listing website, which launched its own mortgage lending arm, Zillow Home Loans, late last year. That is because lenders deny mortgages for Black applicants at a rate 80% higher than that of White applicants, according to 2020 data from the Home Mortgage Disclosure Act.” Sure enough, the article tells the story of an African American man who had all the right credentials to refinance his home—a six-figure income, a 800 FICO credit score, and 20% equity in his home. When he told two separate lenders he was Black, they both turned him away . Thus, unable to acquire the loans to buy and refinance houses Black people are prevented from acquiring wealth in their own lifetimes, and generationally, which then impacts the debt burden they bear. “That pattern of homeownership and generational wealth building is broken for many black families. In the first quarter of 2020, 44 percent of black families owned their home, compared with 73.7 percent of white families, according to the Census Bureau,” reports the Washington Post . “The gap is wider in some cities, with just 25 percent of black families owning a home in Minneapolis compared with 76 percent of whites, which is the widest gap in U.S. cities with more than 1 million residents , a study by Redfin real estate brokerage found.” African Americans Obstructed from Tax Benefits and Advantages Aside from the obvious benefits of having a well-paying career and owning a home, this well-documented history of job and mortgage market discrimination keeps African Americans from tax benefits and other advantages associated with both accomplishments. “Because African Americans tend to have lower incomes, they inevitably receive fewer tax benefits—even if they are homeowners or have retirement savings accounts. The bottom line is that persistent housing and labor market discrimination and segregation worsen the damaging cycle of wealth inequality,” reports the Center for American Progress. What’s more, because Black people are significantly less likely to own homes than white people due to searing inequalities, they also have less access to the savings and tax benefits that come with owning a home—like allowing you to deduct mortgage interest of up to $750,000. In fact, according to Tax Policy Center , that inequity is baked into the tax code: “Some tax policies can also exacerbate income and wealth inequalities stemming from long-standing discrimination in areas such as housing, education, and employment.” Along with barriers to accessing the jobs to buy an asset like a house, a lack of access to the tax benefits of both have a direct impact on savings and debt in the African American community. In effect, it is very likely that the debt you may have is due to an unfair system, particularly if you are a person of color. This is where Different Answer can come in. At Different Answer, I am committed to working with marginalized people to help them eliminate debt, because I believe everyone deserves to live with financial peace. While I cannot change the systems that create wealth inequality, I can help you understand the reasons for your debt and show you the tools to eliminate it so you can create the life you deserve. To learn more and talk about the possibilities, book some time with me and let's chat.